Community Banking

Community banking provides socio-economic growth of communities through the sharing of resources with a main goal of servicing and supplying adequate financial services to its community members.

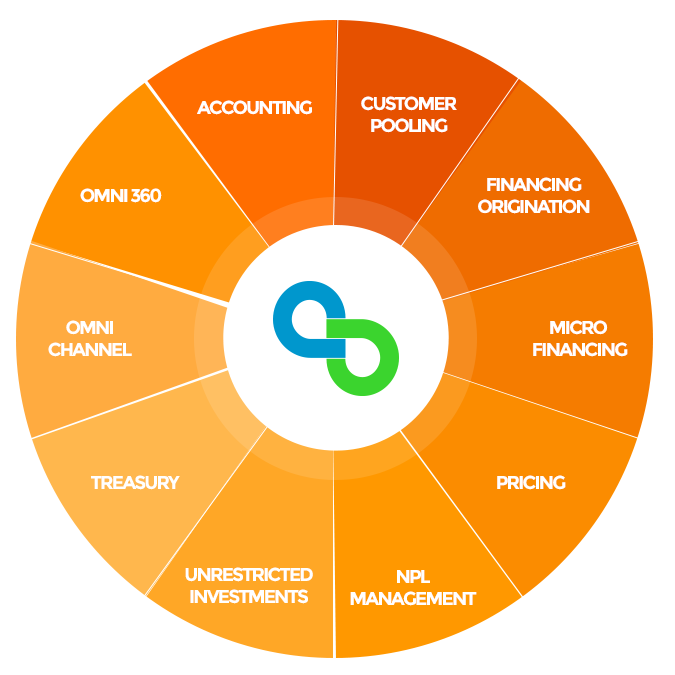

SYNERGIES4COMMUNITYBANKING (S4CmB) empowers the financial sector to reach and help developing the communities in emerging markets where access to financial services is severely constrained. S4CmB is a dedicated and Community banking specialized technology solution enables streamline operations, reduces risks and costs, spreads institution products and services to the different communities, directly and indirectly.

The solution covers all aspects of community banking activities from the sources of funds to the uses of funds with all relevant services and products, by providing strong customer focus on micro entrepreneurs; ranging from individual entrepreneurs and customers to group-based models and group centers management. The solution ensures also adequate Sharia compliant financing tool by offering adaptable financing to micro entrepreneurs, based on financial analysis that aims at estimating client’s repayment capacity; S4CB provides access to a full range of Islamic finance and banking services to the community clients, through its Omni-Channel and digital Delivery Channel solution;

Moreover, S4CmB provides additional category of solution and services, which includes:

· Islamic finance activities: such as investment deposit account, bill payment, person to person payment, wallet, remittances, etc..

· Lifecycle Needs: such as weddings, funerals, childbirth, education, etc..

· Personal Emergencies: such as sickness, injury, unemployment, theft, etc..

· Disasters: such as fires, floods etc..

· Investment Opportunities: expanding a business, agriculture, real estate, buying, equipment, etc..

· Delivery of the banking and financing products and services through a comprehensive Omni-channel.