SME Banking

Small and medium enterprises (SME) are essential to any economic development, in specific in the in emerging markets. The effective management of financing to SMEs can contribute significantly to the overall growth and profitability of the financial institutions.

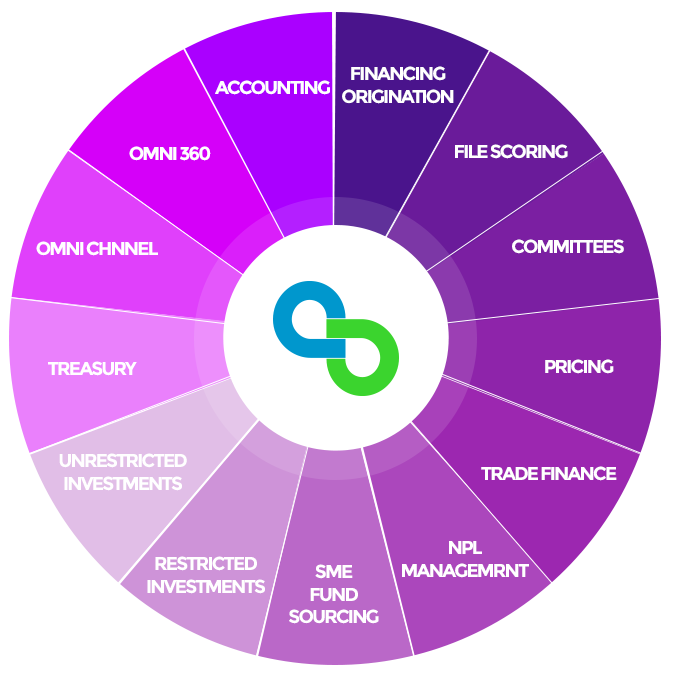

Synergies For SME Banking , i.e. S4SmB, empowers financial institutions to provide SMEs access to relevant and agile financial services, which has historically been severely constrained, to Grow their business with tailored solutions designed around their needs.

The solution covers all aspects of SME Banking activities from the sources of funds to the uses of funds with all relevant and adequate services and products, by providing strong corporation focus on small enterprises and start-ups. Ensure adequate Sharia compliant financing tool by offering adaptable and relevant financing and services to SMEs, S4SmB provides access to a full range of Islamic finance and banking services to the SMEs, through its Omni-Channel and digital Delivery Channel solution.

Moreover, S4SmB provides additional category of solution and services, which includes:

- Islamic SME-banking activities: such as investment deposit account, payments, remittances, etc..

- Business Accounts

- Electronic Collection and payment

- Financing management and Exposures

- Trade and Working Capital Services

- Customized banking solutions

- Guarantee & Letter of Credit

- Foreign exchange management

- SME financing and factoring

- Special purpose adaptable Financing

· Investment Opportunities: expanding a business, buying equipment, etc..

· SME product and services delivery through a comprehensive Omni-channel solution, i.e. mobile, internet, Agents, etc..